Medicare 101

Medicare Enrollment Periods

| Term | Description |

|---|---|

| Annual Enrollment Period (AEP) (Oct 15 - Dec 7) | Change Medicare Advantage/Drug Plan (or switch back to Original Medicare) for next year. |

| Initial Coverage Election Period (ICEP) (7 months around your 65th birthday) | Sign up for Medicare for the first time. |

| Medicare Advantage Open Enrollment (OEP) (Jan 1 - Mar 31) | Switch between Medicare Advantage Plans (or go back to Original Medicare) if already enrolled. |

Medicare Parts and Plans

| Term | Description |

|---|---|

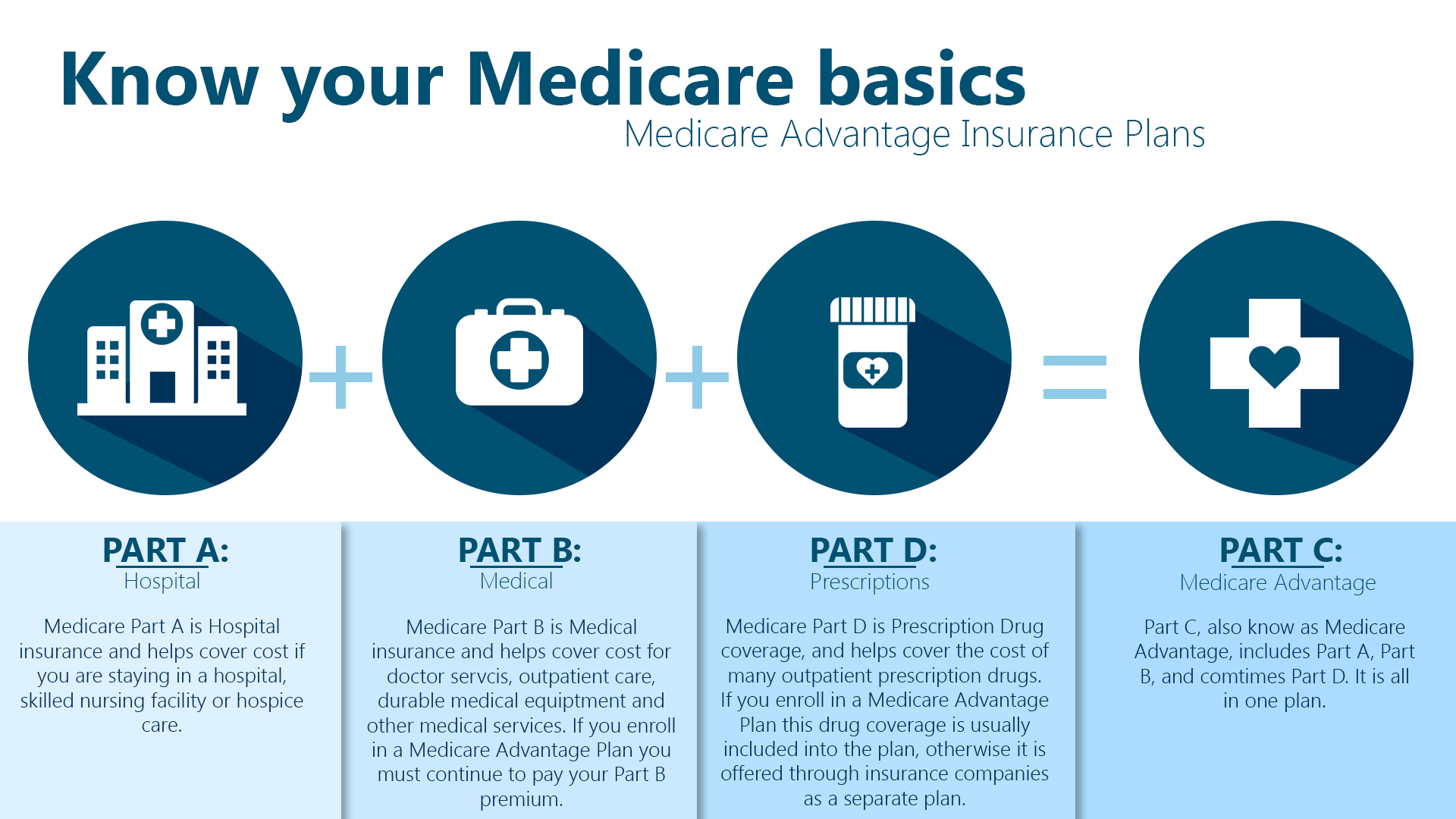

| Medicare Advantage (Part C) | Private plan with benefits similar to Original Medicare (A & B), often including extras like drug coverage. |

| Original Medicare (Parts A & B) | Traditional government-offered insurance. |

| Part A (Hospital) | Covers hospital stays, nursing facilities, hospice, and some home health. |

| Part B (Medical) | Covers doctor visits, preventive care, outpatient care, and medical supplies. |

| Part D (Drug) | Optional prescription drug coverage (offered as part of Advantage plans or on its own). |

| Special Needs Plan (SNP) | Advantage plan with extra benefits for people with specific needs (chronic illness, Medicaid, or long-term care). |

| Resource | Description |

|---|---|

| Traditional Medicare vs Medicare Advantage vs Medicare Part D vs Medicare Supplement Explained | Dr. Eric Bricker talks on how traditional Medicare offers broad coverage with no network restrictions, but leaves you responsible for out-of-pocket costs. Medicare Advantage plans often come with lower premiums and extra benefits, but may limit your choice of doctors and have additional approval steps for care. |

Source: Blue Cross and Blue Shield of Nebraska

Medicare Costs and Coverage

| Term | Description |

|---|---|

| Coinsurance | A percentage of the cost you pay for certain covered services after you've met your deductible. |

| Copayment | A fixed amount you pay for certain covered services, like a doctor visit. |

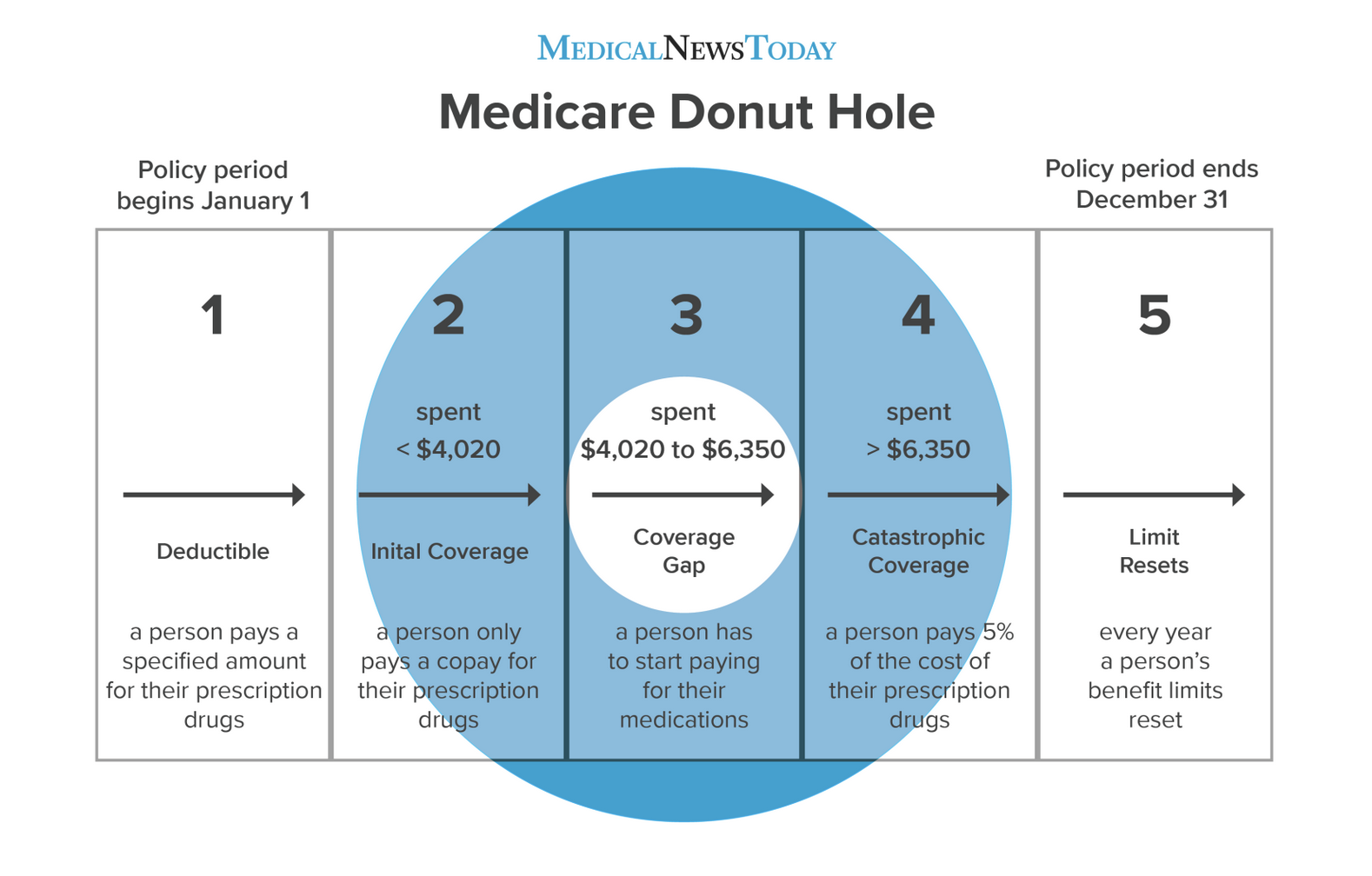

| Coverage Gap ("Donut Hole") | The gap in Part D prescription drug coverage where you pay a higher share of the cost for your medications. |

| Creditable prescription drug coverage | A health plan that meets Medicare's standards for prescription drug coverage. Helps you avoid the donut hole. |

| Deductible | The amount you must pay for covered services before Medicare starts to pay. |

| Evidence of Coverage (EOC) | A document from your Medicare plan that shows what services are covered and what you may owe. |

| Out-of-pocket costs | All the costs you pay for your Medicare coverage, including premiums, deductibles, coinsurance, and copays. |

| Premium | The monthly payment you make to have Medicare coverage. |

Plan Types

| Term | Description |

|---|---|

| HMO | Requires a primary care doctor who coordinates care within the plan's network. |

| Medigap | Sold by private insurers to help cover out-of-pocket costs in Original Medicare (not including drugs). |

| PPO | Lets you choose your own doctors and hospitals, but using in-network providers saves money. |

Duals

| Type | Description |

|---|---|

| C-SNP (Chronic Illness SNP) | Designed for people with specific chronic conditions like heart disease, diabetes, or COPD. May offer benefits tailored to these conditions. |

| D-SNP (Dual Eligible SNP) | For people who qualify for both Medicare and Medicaid. May offer simplified benefits administration and potentially lower out-of-pocket costs. |

| Dual Eligible Plan (May vary by program) |

Combines Medicare and Medicaid benefits into a single plan. Can simplify coverage and potentially offer additional benefits for eligible individuals.

**Note:** Specific details of Dual Eligible Plans can vary depending on the program and location. |

| I-SNP (Institutional SNP) | For individuals residing in long-term care facilities (nursing homes). Often provide coordinated care with facility staff. |

Value-Based Care

| Term | Description |

|---|---|

| ACO (Accountable Care Organization) | Network of providers working together to coordinate care for Medicare patients. They are accountable for cost, quality, and patient experience. |

| Fee-for-Service (FFS) | Traditional Medicare payment system that reimburses providers based on the number of services delivered. MSSP aims to move away from this. |

| Performance Measures | Metrics used to judge ACO success in quality, cost control, and patient experience. |

| Risk Adjustment | Accounts for differences in patient health needs to ensure a fair comparison of ACO performance. |

| Shared Savings | Bonus earned by ACOs for delivering quality care and reducing Medicare spending. |

| Tracks | Different participation levels in the MSSP (Tracks 1-3) with varying risk and reward structures. |

Senior Care

| Resource | Description |

|---|---|

| America's Seniors and the Challenges of Old Age |

In this article the NYTimes writes that the US is aging rapidly and needs to prepare for the social and economic consequences, including potential labor shortages, strain on social programs, and the need for more elder care. |

| Dying Broke: A KFF Health News-New York Times Project |

KFF Health News and The New York Times examine how the immense financial costs of long-term care drain older Americans and their families. |

| How Do We Fix the Scandal That Is American Health Care? |

Nicholas Kristof argues that the U.S. has a healthcare crisis despite advanced technology, and improving health requires addressing access, behavior, and social determinants. Key Points

|

| Long-Term Care: Last Week Tonight with John Oliver |

John Oliver explains the industry behind nursing homes and assisted living facilities, and why long-term care needs fixing. Key Points

|

| More American Seniors Live Alone |

People over 60 are more likely to live alone in the United States and Europe than in other regions of the world. |

| Venturing in Senior Care: Observations and Predictions for 2024 and Beyond |

Daniel Kaplan writes how senior living and healthcare are merging, affordability remains a major challenge, and new care models are emerging to address these issues. Key Points

|

| Why Are Older Americans Drinking So Much? |

The pandemic played a role in increased consumption, but alcohol use among people 65 and older was climbing even before 2020. |

Patient Persecptives

| Resource | Description |

|---|---|

| Healthcare is Great on Medicare |

Dr. Eric Bricker highlights that while Medicare beneficiaries enjoy high satisfaction with their healthcare plans, the program faces financial challenges. Key Points

|

| r/medicare |

Read how Medicare patients try to understand the complex Medicare system. |

Policy

| Resource | Description |

|---|---|

| Center for Medicare and Medicaid Innovation Primary Care Models |

The Center for Medicare and Medicaid Innovation offers four primary care models to incentivize quality care delivery, with a focus on expanding access and rewarding value-based practices (Center for Medicare and Medicaid Innovation). Key Points

|

| FAQs on Medicare Financing and Trust Fund Solvency |

The KFF explains that the Medicare Hospital Insurance trust fund is projected to be depleted by 2028 [more recenlty this date has been moved to 2036], raising concerns about future program financing. Key Points

|

| Medicare Part D Coverage of Drugs Selected for the Drug Price Negotiation Program |

In a study by Patterson et al., high coverage of drugs selected for Medicare price negotiation was observed in 2019 and 2023, but concerns remain about potential limitations on future access due to utilization management practices. Key Points

|

| Pondering CMS' Ambitious "Making Care Primary" Model |

Ben Schwartz argues that while Medicare Advantage offers benefits, it has limitations, and explores how a different model, Making Care Primary (MCP), could address those limitations by improving care coordination and potentially offering more integrated specialist care. Key Points

|

Startup Learnings

| Resource | Description |

|---|---|

| Dr. Chris Chen Speaks at the Global Value-Based Healthcare Symposium |

Dr. Chris Chen spokes about ChenMed's model of medicine is a pure value-based care model. Key Points

|

| Exploring the Elder Care & AgeTech Space |

Navigating the complex elder care landscape requires thorough research, targeted problem identification, and a willingness to adapt and pivot in order to develop a solution with a sustainable competitive advantage. Key Points

|

| Farzad Mostashari, Aledade, on the power of primary care |

Alex Wess, published in The Pulse by Wharton Digital Health, chats with Dr. Farzad Mostashari about how Aledade believes independent primary care physicians are best positioned to benefit from value-based care. Key Points

|

Challenges in Medicare

| Resource | Description |

|---|---|

| Hospitals and Doctors Are Fed up With Medicare Advantage |

KFF writes how Medicare Advantage plans are facing growing criticism from hospitals and doctors due to claim denials, preapproval hassles, and low reimbursement rates, leading to new regulations and potentially impacting patient choice. Key Points

|

| March 21 Web Event: Unpacking the Controversy Over Medicare Advantage |

On Thursday, March 16, 2023, KFF hosted an hour-long web briefing focused on Medicare Advantage and some of the policy challenges. Key Points

|

| Medicare's push to improve chronic care attracts businesses, but not many doctors |

In this article Phil Galewitz and Holly K. Hacker discusses the debate surrounding how much Medicare pays Medicare Advantage plans, including the risk adjustment system and potential effects of proposed payment changes. Key Points

|

People/Newsletters to Follow

| Resource | Description |

|---|---|

| Mastering Medicare |

A podcast to demystify healthcare and Medicare for senior-serving professionals and providers. |

| Benjamin Schwartz, MD, MBA |

Ben is one of the insightful people in healthcare. |

| Bryce Platt, PharmD |

Every day Bryce posts highly insightful content in the Medicare space. He is somebody everyone should follow if they are interested in the space. |

| TheGerontechnologist |

TheGerontechnologist compiles great content on AgeTech. |

| Yubin Park, PhD |

Yubin consistently posts great data analysis in the Medicare space. |

| Zach Davis |

Zach's goal is to help ACOs in the MSSP, ACO REACH, Medicare Advantage and Commercial markets tap into the actuarial expertise that the health insurance industry has relied on for decades. |